how to pay indiana state withholding tax

The withholding tax rate is a graduated scale. This includes tax withheld from.

What Is Local Income Tax Types States With Local Income Tax More

Pay my tax bill in installments.

. When completed correctly this form ensures that a businesss withholding taxes by county are reported accurately and timely. Annual Withholding Tax Form. A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding W 2 Form For Wages And Salaries For A Tax Year By Jan 31 2 Share this post.

In addition the employer should look at Departmental Notice 1 that details the withholding rates for each of Indianas 92 counties. INtax only remains available to file and pay the following tax obligations until July 8 2022. Select Next under the Accounts to be registered box.

Other important employer taxes not covered here include federal UI tax and state and federal withholding taxes. Newer Post Older Post Home. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

How to figure out your income tax withholding for 2021. Register and file this tax online via INTIME. Claim a gambling loss on my Indiana return.

Once registered an employer will receive an Indiana Taxpayer Identification Number. Download Now Employers required by the Internal Revenue Service to withhold income tax on wages must register with the Indiana Department of Revenue DOR as a withholding agent online through INBiz httpinbizingov. According to PA 82 and 83 of 1991 an Accelerated Withholding Tax filer is required to remit withholding taxes the same day as federal payments regardless of the amount due.

However if not completed correctly there is a. Take the renters deduction. To register for Indiana business taxes please complete the Business Tax Application.

INTAX only remains available to file and pay special tax obligations until July 8 2022. All future Sales Use and Withholding payments should be made online through MTO. If you paid state sales tax of seven percent or more to the other state you do not owe use tax to Indiana.

A request should be sent that verifies the payment amounts for nonresident withholding that the payments be moved to the corporate account and that the WH-1s should be zeroed out. Have more time to file my taxes and I think I will owe the Department. Withholding tax applies to almost all payments made to employees for services they provide for your business.

You then send this money as deposits to the Minnesota Department of Revenue and file withholding tax returns. Different states have different rules and rates for UI taxes. Retrieve the updated Company IDDebit Block Numbers effective January 2015.

Those who are self-employed generally pay tax this way. This will be your Location ID as listed on your Withholding Summary. You may copy and paste this number directly into Zenefits hyphen included.

Box 15 on Form W-2 must list the state for which the employer withheld the taxes and more importantly to which the employer remitted the taxes. Find Indiana tax forms. Pension and annuity payments.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax accounts in one convenient location 247. See Form 1040-ES Estimated Taxes for Individuals for details. Increased Indiana County Tax Rates Effective October 1 2021.

Dor Completing An Indiana Tax Return Irs Taxes Payment Plan Darien Il Www Mmfinancial Org Irs Irs Payment Plan Tax Payment Plan. Underpayment of Indiana Withholding Filing. The following Indiana counties increased their county income tax rates effective for wages paid on or after October 1 2021.

To register for withholding for Indiana the business must have an Employer Identification Number EIN from the federal government. Figure the tentative withholding amount Now use the 2021 income tax withholding tables to find which bracket 2020 falls under for a single worker who is paid biweekly. Apply online using the IN BT-1Online Application and receive a Taxpayer ID number in 2-3business days.

Register and file this tax online via INTIME. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. In Indiana state UI tax is just one of several taxes that employers must pay.

Indiana Department of Revenue. The DORs INtax system or electronic funds transfer EFT. The WH-1 is the Indiana Withholding Tax Form and is required for any business that is withholding taxes from its employees.

Know when I will receive my tax refund. You may also need to complete the FT-1 application for motor fuel taxes including special fuel or transporter taxes or the AVF-1 application for aviation fuel excise tax. AccuPays payroll software will be updated as soon as possible for the October 1 2021 rate changes.

However as of 2013 all Indiana withholding tax payments and WH-1s must be filed electronically. Other sources of income. Minnesota Withholding Tax is state income tax you as an employer take out of your employees wages.

Formerly many Indiana withholding tax payers could pay on paper by sending in Form WH-1 Indiana Employers Withholding Tax Return with a check. Here are the basic rules for Indianas UI tax. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

Form W-4V Voluntary Withholding Request. Sign title etc the signature box Select Add to Payment Cart button. Pay as You Go So You Wont Owe.

Register and file this tax online via INTIME. Withholding tax is the amount held from an employees wages and paid directly to the state by the employer. Please send written correspondence to.

Use an employees Form W-4 information filing status and pay frequency to figure out FIT withholding. You can also find an existing Taxpayer ID Number. Withholding Accelerated Electronic Funds Transfer EFT Taxpayers who have an annual Withholding liability of 480000 in the preceding calendar year.

Please call the Corporate Income Tax section at 317 232-0129 for further information. Form W-4S Request for Federal Income Tax Withholding from Sick Pay. What are state withholdings on w2.

Overview of Indiana Taxes Indiana has a flat tax rate meaning youre taxed at the same 323 rate regardless of your income level or filing status. This information only applies to accounts registered to electronically pay taxes using the Electronic Funds Transfer EFT Debit method. You have two options for electronic payments.

Indiana Withholding Tax Voucher. Contact your AccuPay payroll specialist at 317. In the Withholding Tax Assign Withholding Tax to Locations box register each location youll need date first wages withheld as well as anticipated monthly income select Next.

You must file a.

State Payroll Withholding Tax Account Number Edit

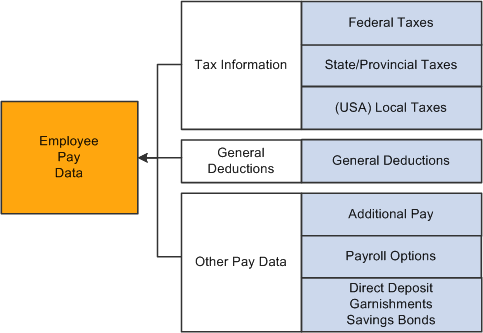

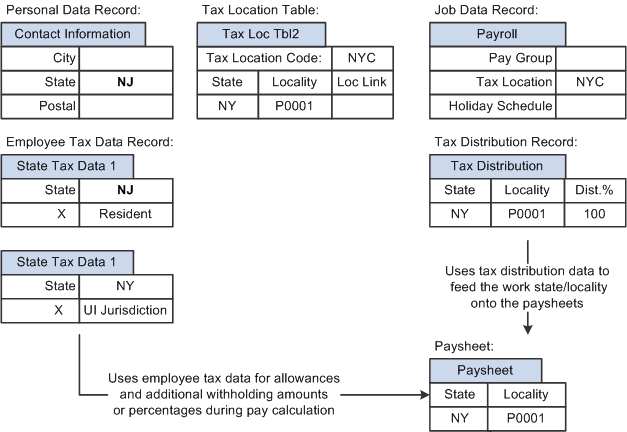

Peoplesoft Payroll For North America 9 1 Peoplebook

Pass Through Entity And Trust Withholding Tax

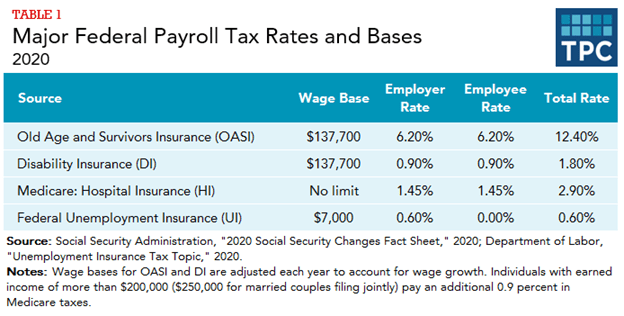

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

2022 Federal Payroll Tax Rates Abacus Payroll

Wht Definition Withholding Tax Abbreviation Finder

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

W 4 Form How To Fill It Out In 2022

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

2020 Minnesota Minnesota Income Tax Withholding Download Printable Pdf Templateroller

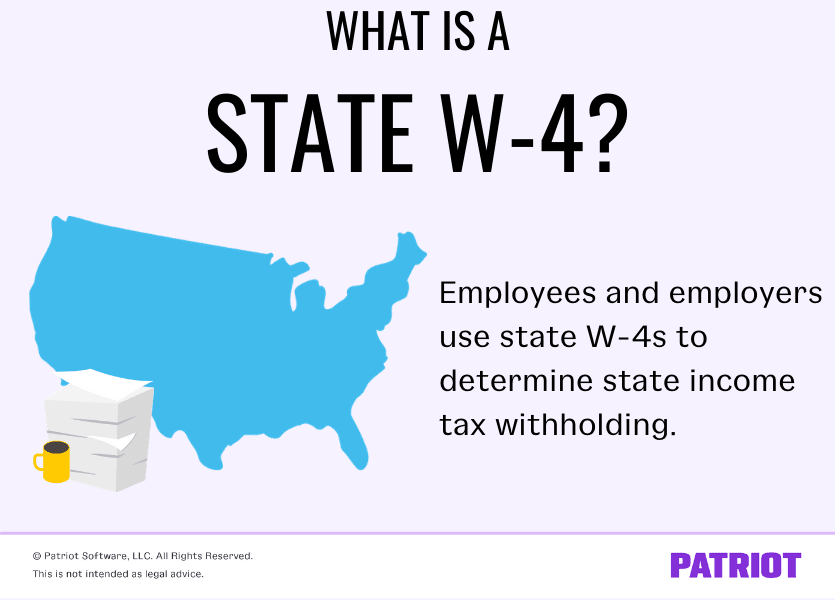

State W 4 Form Detailed Withholding Forms By State Chart

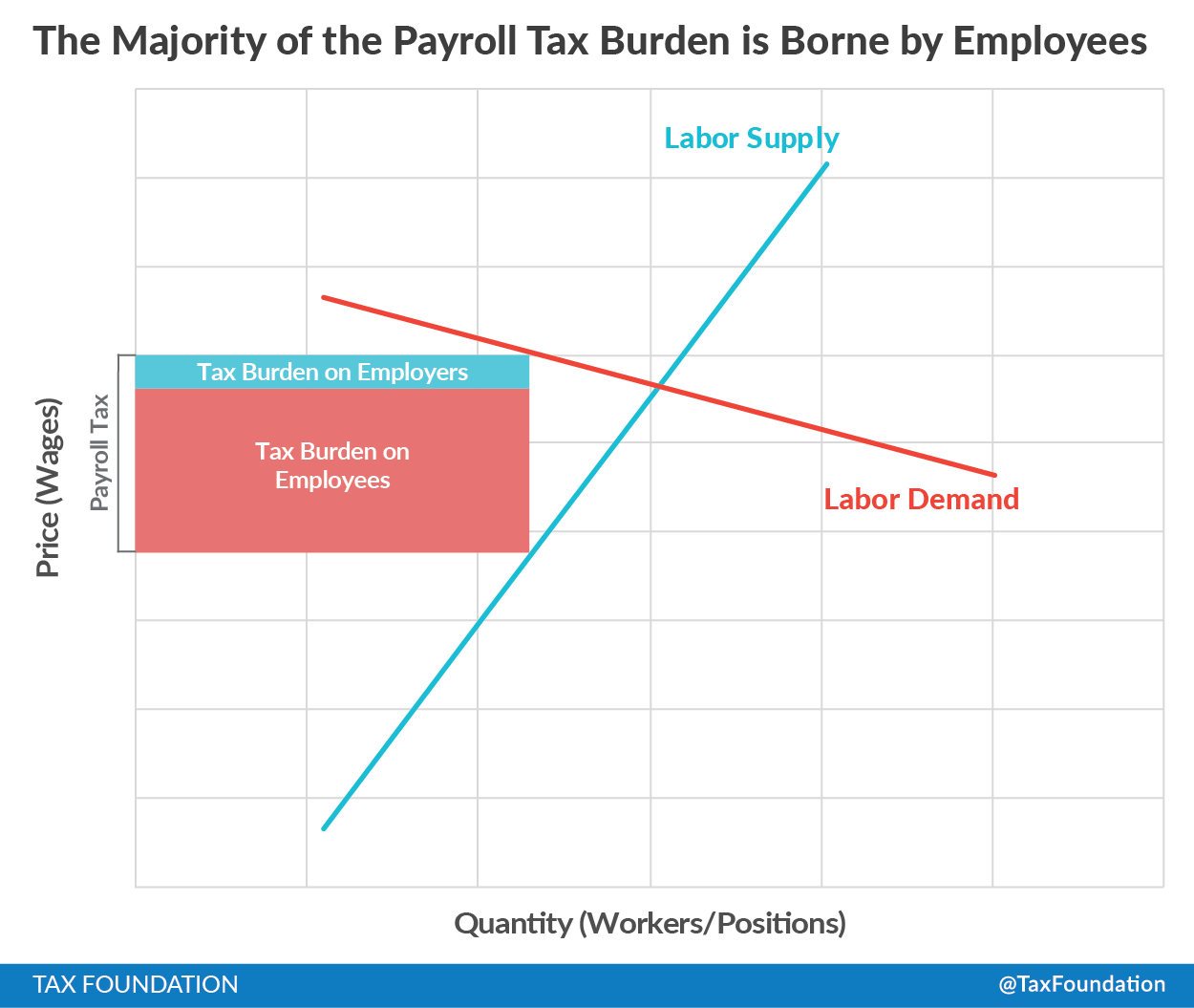

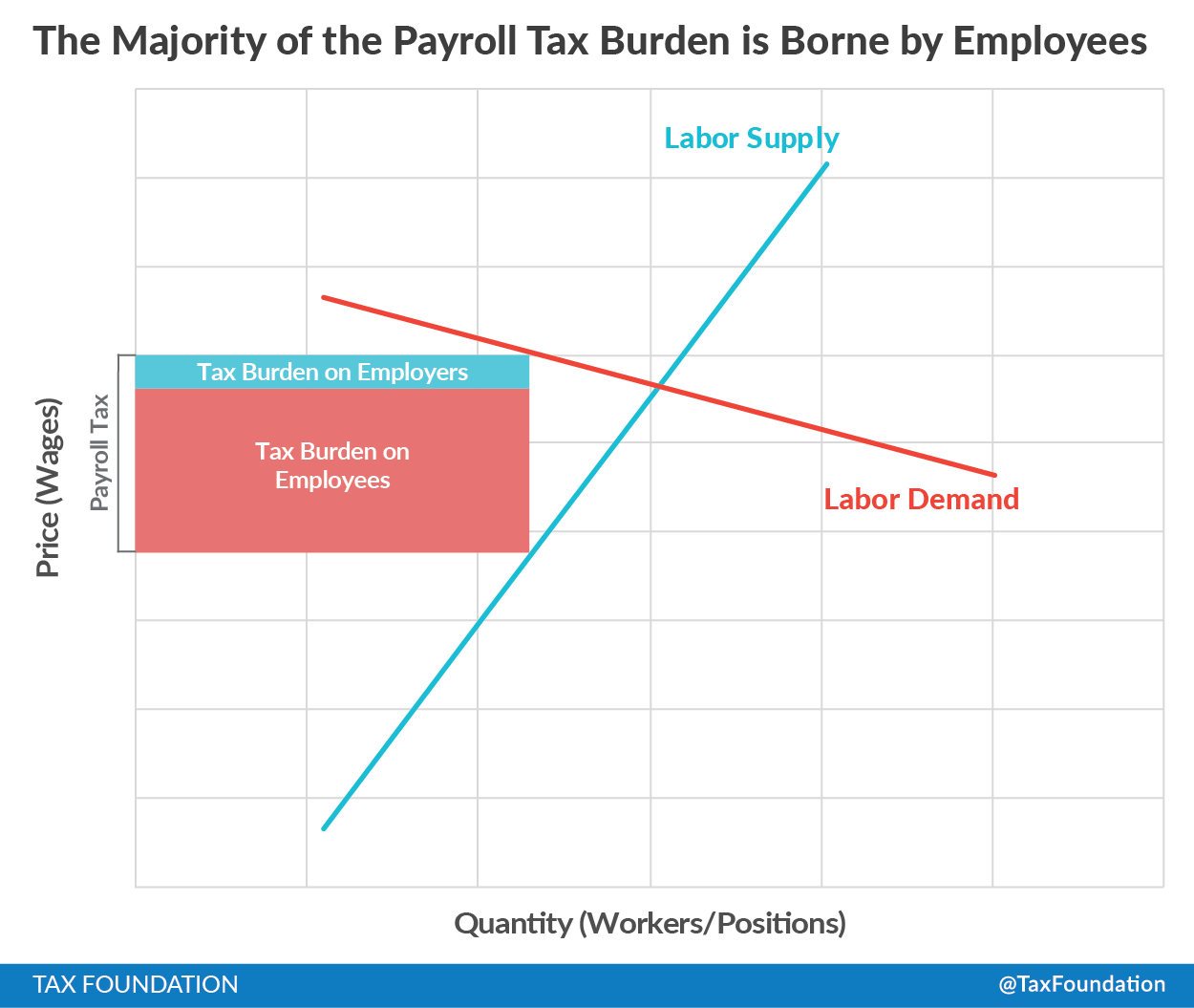

What Are Payroll Taxes And Who Pays Them Tax Foundation

Payroll Tax What It Is How To Calculate It Bench Accounting

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Peoplesoft Payroll For North America 9 1 Peoplebook

Irs Form W8 Irs Tax Forms Withholding Tax Irs Forms Irs Taxes Irs Tax Forms

Payroll Tax Submission Rejection